Remember the carefree days of childhood, when a crisp five-dollar bill felt like a magic wand summoning ice cream empires and candy kingdoms? Fast forward to adulthood, and that same fiver barely covers a single scoop, leaving you staring at the price tag with the bewilderment of a lost astronaut.

Rental Inflation: Where Home Becomes a Gamble

Forget soaring house prices, the rental market is where inflation truly spins its roulette wheel. In the US alone, average rent climbed by a staggering 14.1% in 2022, outpacing wage growth and leaving millions facing a brutal choice: eat or have a roof over their heads. (Source: Apartment List) This isn’t just a numbers game; it’s a human drama unfolding in eviction notices and sleepless nights.

The culprits? A potent cocktail of factors: tight housing supply, corporate landlords prioritizing profit over people, and the influx of investors seeking havens in a turbulent financial market.

The result? A generation priced out of homeownership, forced into a precarious rental dance where one rent hike away lies homelessness.

Education Erosion: Knowledge on Sale, But at What Cost?

Remember dreaming of college as a gateway to boundless possibilities, not a debt sentence guaranteeing years of ramen-fueled nights? In today’s inflationary landscape, higher education feels like a gilded cage, luring students with the promise of knowledge but saddling them with crippling debt. College tuition, already astronomical, has been on a relentless upward spiral, increasing by a staggering 49% over the past decade alone. (Source: College Board)

The culprit? A perfect storm of factors, from ballooning administrative costs to an obsession with prestige over practicality. Universities, chasing rankings and donor dollars, have inflated their overhead like overproof soufflés, passing the buck to students in the form of ever-escalating tuition fees.

The consequence? A generation priced out of knowledge, forced to choose between financial stability and intellectual pursuits.

Healthcare Hijacked: When Wellness Comes at a Premium

The irony is palpable: in the face of a global pandemic, healthcare shouldn’t be a luxury good. Yet, inflation has transformed hospitals into cost-prohibitive fortresses, with medical bills resembling ransom notes. Hospital costs in the US, already the highest in the developed world, climbed by 4.6% in 2022, outpacing overall inflation. (Source: Centers for Medicare & Medicaid Services)

The culprits? A complex web of factors, from pharmaceutical monopolies jacking up drug prices to an aging population straining resources.

The result? Millions skipping vital checkups, rationing medication, and delaying treatment, all because good health comes at a price their wallets can’t afford. This isn’t just a financial crisis; it’s a public health one, jeopardizing the well-being of a nation.

Mental Malaise: Anxiety's Inflationary Tax

Inflation isn’t just about numbers on a spreadsheet; it’s a psychological burden that weighs heavily on individuals and communities. Constant news of rising prices and shrinking paychecks fuels anxiety, erodes trust in institutions, and disrupts social cohesion. This “inflation anxiety” can lead to reduced spending, increased crime, and even political unrest. (Source: Federal Reserve Bank of St. Louis)

The challenge? Addressing the emotional side of inflation alongside the economic one. Open communication, transparent policy measures, and a focus on social safety nets are crucial to mitigating the mental toll of this economic storm.

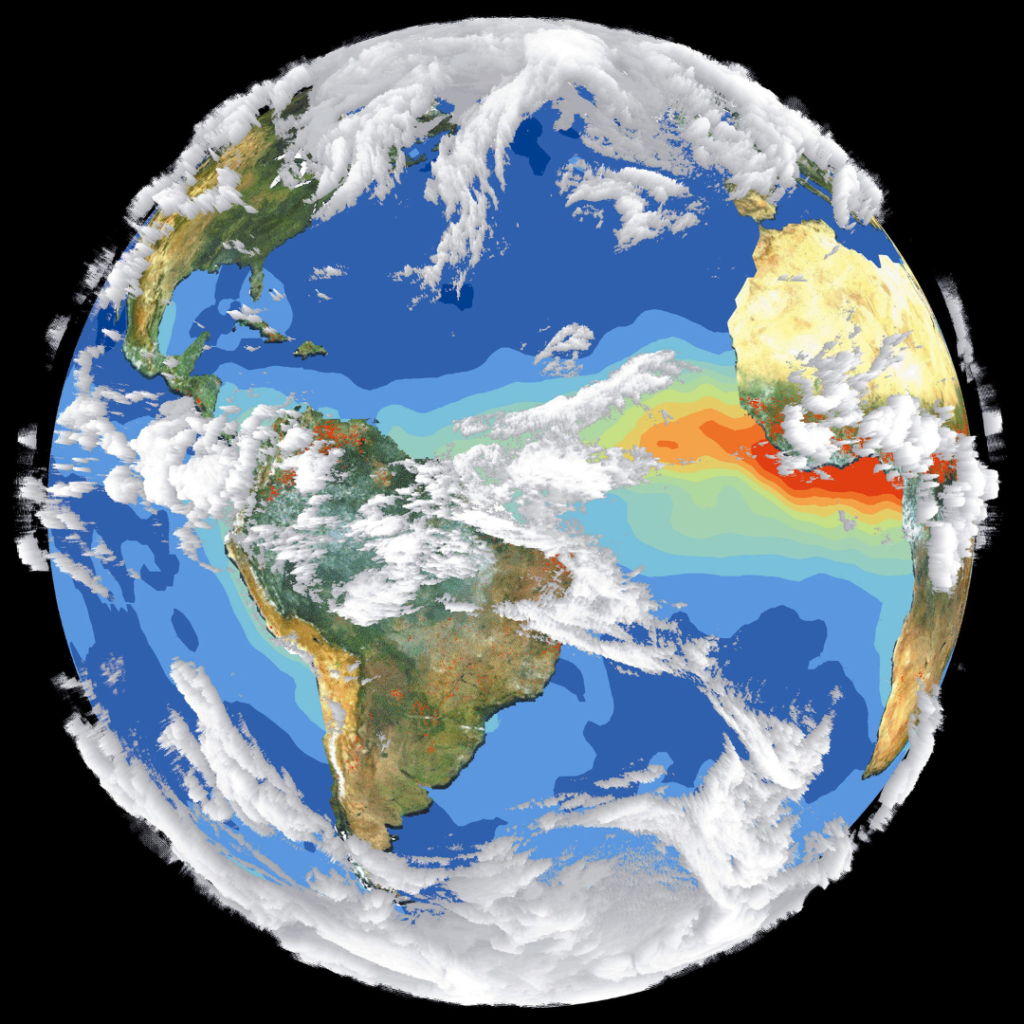

Climate Crossroads: Green Dreams, Pricey Realities

The fight against climate change is undoubtedly crucial. But the transition to a greener future isn’t without its inflationary bumps. The demand for renewable energy has exposed critical bottlenecks in the supply chain, driving up the cost of essential materials like lithium and cobalt. This “greenflation” translates to higher prices for solar panels, electric vehicles, and even everyday goods like groceries, as production costs soar. (Source: International Energy Agency)

The conundrum? Balancing environmental needs with immediate economic realities. While the long-term benefits of mitigating climate change are undeniable, the short-term pain at the checkout counter can be politically perilous. Finding a way to make the green transition affordable and just is the delicate challenge of our time.

Beyond the Headlines: A Call for Nuanced Narratives

So, the question remains: In this era of rising prices and shrinking budgets, how can we build a more resilient economy, one that ensures opportunity and well-being for all, not just those with wallets shielded from inflation’s invisible tax?

To read more valuable content follow us on blognarrator.com