Table of Contents

Remember the fable of the hare and the tortoise? The hare, all speed and bravado, loses to the plodding, persistent tortoise. In the world of investing, there’s a similar underdog: Dollar-Cost Averaging (DCA). While flashier strategies chase market highs, DCA quietly but consistently wins the long race, leaving its flashy counterparts breathless in the dust.

But Dollar Cost Average isn’t just about patience; it’s about resilience, about defying the emotional rollercoaster of the market. Imagine yourself, heart pounding, at the casino betting on red. That’s what most investors do – they try to time the market, buy low, sell high. But the market? It’s a fickle beast, more likely to leave you with red cheeks than red numbers.

Dollar Cost Average, on the other hand, takes a deep breath and walks into the casino, not to gamble, but to sip coffee and people-watch. Every month, it throws a ten-dollar chip onto the table, regardless of whether the roulette wheel spins red or black. Over time, that consistent, unfazed approach builds a surprisingly sizable pile of winnings, leaving the impulsive gamblers bewildered and empty-handed.

That’s the magic of Dollar Cost Average: it takes the emotion out of investing. It doesn’t require you to predict the future; it simply asks you to show up, month after month, and be present in the market. Let’s delve deeper into this tortoise-approved strategy and explore its hidden strengths:

1. Dollar Cost Average Advantage

Data Point: A study by Vanguard found that over a 20-year period, investors who used DCA to invest in a mix of stocks and bonds achieved a higher average annual return compared to those who invested a lump sum at the beginning of the period. (Source: Vanguard Investment Strategies)

2. The Discipline Dynamo

Data Point: A study by the Employee Benefit Research Institute found that individuals who participated in regular payroll deduction retirement savings plans accumulated significantly more retirement savings than those who did not. (Source: Employee Benefit Research Institute)

3. The Anxiety Antidote

Data Point: A study by the American Psychological Association found that financial stress is associated with a variety of negative health outcomes, including depression, anxiety, and heart disease. (Source: American Psychological Association)

4. Beyond Stocks

The DCA Versatility: Don’t think DCA is just for stock market rookies. It works beautifully for any long-term investment, from real estate to cryptocurrencies. By consistently buying over time, you benefit from averaging out fluctuations and building a diversified portfolio that weathers market storms. It’s the swiss army knife of investment strategies, adaptable to any asset class and financial goal.

Data Point: A study by Fidelity Investments found that DCA investors in Bitcoin outperformed lump sum investors over a five-year period. (Source: Fidelity Investments)

5. The Tortoise Triumphs

So, if you’re tired of the emotional roller coaster of the market, if you want to build wealth with discipline and calm, embrace the underdog. Adopt Dollar-Cost Averaging. Be the tortoise in the financial zoo, and watch your portfolio, like a carefully tended garden, bloom with the quiet power of consistency. Remember, slow and steady wins the financial race, every time.

FREQUENTLY ASKED QUESTIONS ABOUT DOLLAR COST AVERAGE

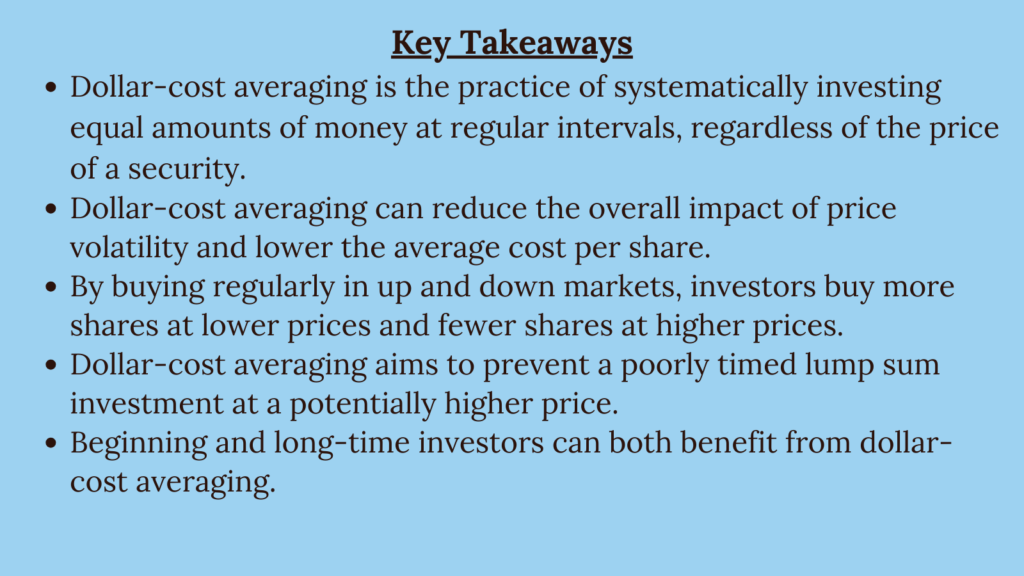

Is Dollar Cost Averaging a good idea?

Dollar cost averaging is the practice of investing a fixed dollar amount on a regular basis, regardless of the share price. It’s a good way to develop a disciplined investing habit, be more efficient in how you invest and potentially lower your stress level—as well as your costs.

Should I dollar-cost average or lump sum?

Dollar-cost averaging can potentially lead to making money over the long term. By consistently investing in a diversified portfolio, investors have the opportunity to benefit from the overall growth of the market and potentially generate favorable returns.

What are the 3 benefits of dollar-cost averaging?

- Emotion: The most common error in investing is investing with emotion.

- Long-Term Plan: Dollar-cost averaging provides you with the ability to seed the market with small sums of investments.

- Avoid Market Mistiming: No one can predict where the market is going at any given time.

What is dollar-cost averaging Warren Buffett?

Warren Buffett was essentially saying that when accumulating investments, be more aggressive when prices are low and less aggressive when they’re high. That’s dollar cost averaging in a nutshell.

What are the 2 drawbacks to dollar-cost averaging?

Dollar cost averaging is an investment strategy that can help mitigate the impact of short-term volatility and take the emotion out of investing. However, it could cause you to miss out on certain opportunities, and it could also result in fewer shares purchased over time.

Hungry for more financial wisdom? If you’d like to explore more insightful articles, feel free to follow blog narrator for continuous updates and in-depth articles.