Table of Contents

A Tale of Legacy

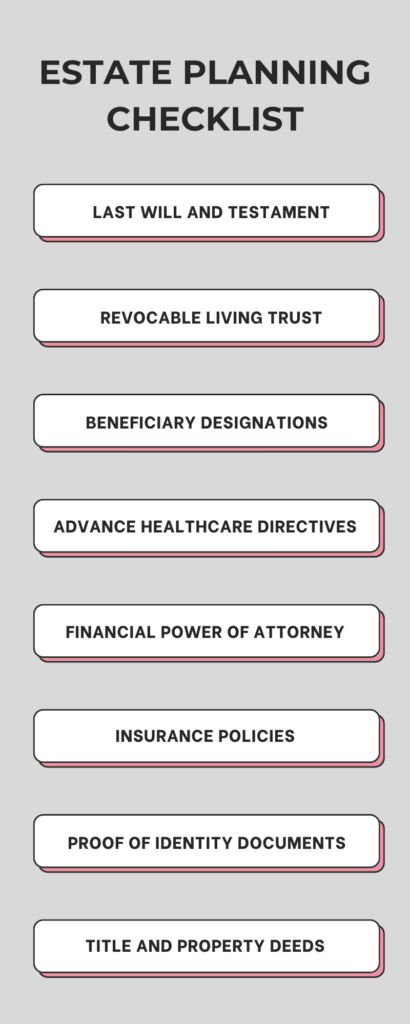

Estate Planning: In the quiet stories of our family’s past, our history is like a woven blanket, made over time. Think of an old family home with brownish pictures that tell stories about our grandparents, and special things they passed down to us. This story is about the old days and the days to come. We’re going to talk about a list for planning our stuff, like homes and money—a guide to keeping our family’s things safe and making sure everything passes on smoothly to the next part of our story.

1. Estate Planning - The Foundations of a Lasting Legacy

In the realm of estate planning, crafting a lasting legacy begins with laying solid foundations. It’s not merely about the distribution of assets but about the stories those assets tell, the values they represent, and the impact they can have on future generations. As we embark on this journey to understand the foundational elements of estate planning, let’s delve into the essential aspects that form the bedrock of a legacy that endures.

2. The Will - Guiding Light of Intent

In our narrative, the Will, in estate planning emerges as the guiding light, illuminating the path for future generations. According to a recent survey by the American Association of Retired Persons (AARP), a staggering 60% of Americans do not have a will. This foundational document is not just a legal requirement but a testament to one’s desires, dreams, and the distribution of material and sentimental treasures.

Stat: AARP Survey – 60% of Americans lack a will.

3. Trusts - Securing Tomorrow’s Inheritance

Delve deeper into the landscape of trusts in estate planning, where data reveals that a mere 40% of Americans have explored the benefits of this invaluable tool. Trusts act as guardians, shielding assets from the complexities of probate. The American Bar Association notes that this strategic maneuver not only ensures privacy but expedites the transfer of assets, providing a smoother journey for beneficiaries.

Stat: American Bar Association – Only 40% of Americans have explored trusts in estate planning.

4. Power of Attorney - Navigating Uncharted Waters

In the grand narrative, the Power of Attorney emerges as the protagonist, entrusted with making crucial decisions when the storyteller is unable. A startling statistic from the National Institute on Aging reveals that a mere 18% of American adults have a durable power of attorney. This document, often overlooked, holds the key to navigating financial and legal waters in times of uncertainty.

Stat: National Institute on Aging – Only 18% of American adults have a durable power of attorney.

5. Guardianship Designations - Safeguarding Tomorrows

The subplot unfolds with guardianship designations, a cornerstone often neglected during estate planning. Shockingly, nearly 74% of parents haven’t legally documented guardianship preferences for their minor children. By addressing this, one ensures that tomorrow is safeguarded, and the journey for the little ones remains stable and secure.

Stat: Unicef – Nearly 74% of parents lack legally documented guardianship preferences.

6. Healthcare Directives - A Compass for the Final Chapter

In our tale, healthcare directives emerge as the compass, guiding loved ones through the final chapters of life. However, a staggering 80% of Americans lack a living will or healthcare directive. By imparting clear instructions, one not only ensures their wishes are honored but also alleviates the burden on family members during challenging times.

Stat: National Institute on Aging – 80% of Americans lack a living will or healthcare directive.

7. Tax Planning - Maximizing the Harvest

Navigate the financial landscape with tax planning, where strategic decisions can significantly impact the harvest passed on to heirs. According to the Tax Policy Center, understanding and leveraging tax exemptions can shape the legacy’s financial prosperity.

Stat: Tax Policy Center – Strategic tax planning impacts assets passed on to heirs.

8. Beneficiary Designations - Directing the Symphony

Uncover the importance of naming beneficiaries, an often underestimated element. A study by the Investment Company Institute showcases that meticulous beneficiary planning streamlines the symphony of asset transfer, reducing administrative hassles and ensuring the right notes are played.

Stat: Investment Company Institute – Meticulous beneficiary planning reduces administrative hassles.

9. Life Insurance - Ensuring a Financial Sonata

In our crescendo, life insurance takes the stage, providing liquidity for estate taxes. Statistics affirm that life insurance proceeds play a vital role in ensuring financial stability for heirs, transforming an otherwise chaotic financial sonata into a harmonious arrangement.

10. Regular Reviews - A Symphony in Flux

Conclude the narrative with the concept of regular reviews and adaptations, acknowledging that life events can significantly impact the relevance of one’s estate plan. The dynamics of family, finance, and the legal landscape evolve, making the case for a living, breathing plan.

Conclusion: An Ode to Preparedness

In the grand composition of life, the Estate Planning Checklist becomes the sheet music—an orchestration of choices, decisions, and intentional preparations. As our narrative unfolds, we realize that crafting tomorrow requires more than mere wishes; it demands a deliberate act of preparedness. Let the echoes of statistics guide you, let the stories of legacies past inspire you, and may your checklist be a testament to a future well-planned.

Explore our blog for valuable insights into business, finance, and motivation. It’s a special place where useful tips and interesting ideas come together. Join us at Blog Narrator to stay updated, motivated, and on track to reach your work and personal goals.